The purpose of this article is to think about where we are and what can happen to gold.

As Warren Buffett mentioned in one of his interviews, there are 3 major categories of investments:

- Anything denominated in a currency: bonds, deposits, cash, …

- Items you buy which don’t produce anything and where you hope that someone will pay you a higher price for later: gold

- Something you value on what it will produce: businesses.

When learning about finance and financial markets, gold is seldom analyzed in detail as a specific asset class that has its own use. Indeed, precious metals and specifically gold, do not seem to be part of the mix in the heads of investors. This is very logical based on modern theories which are based on a fiat currency.

However, one may wonder, what if the things we didn’t expect in terms of being part of reality of this fiat currency universe (e.g. zero interest rates for years), produced something unseen in precious metals, at least for some time ahead.

The gold bugs may, or even would probably argue that gold, is an asset that has demonstrated its value over many centuries as being real money. However, in order to remain pragmatic and seek what is true in practice, let’s consider the following observations.

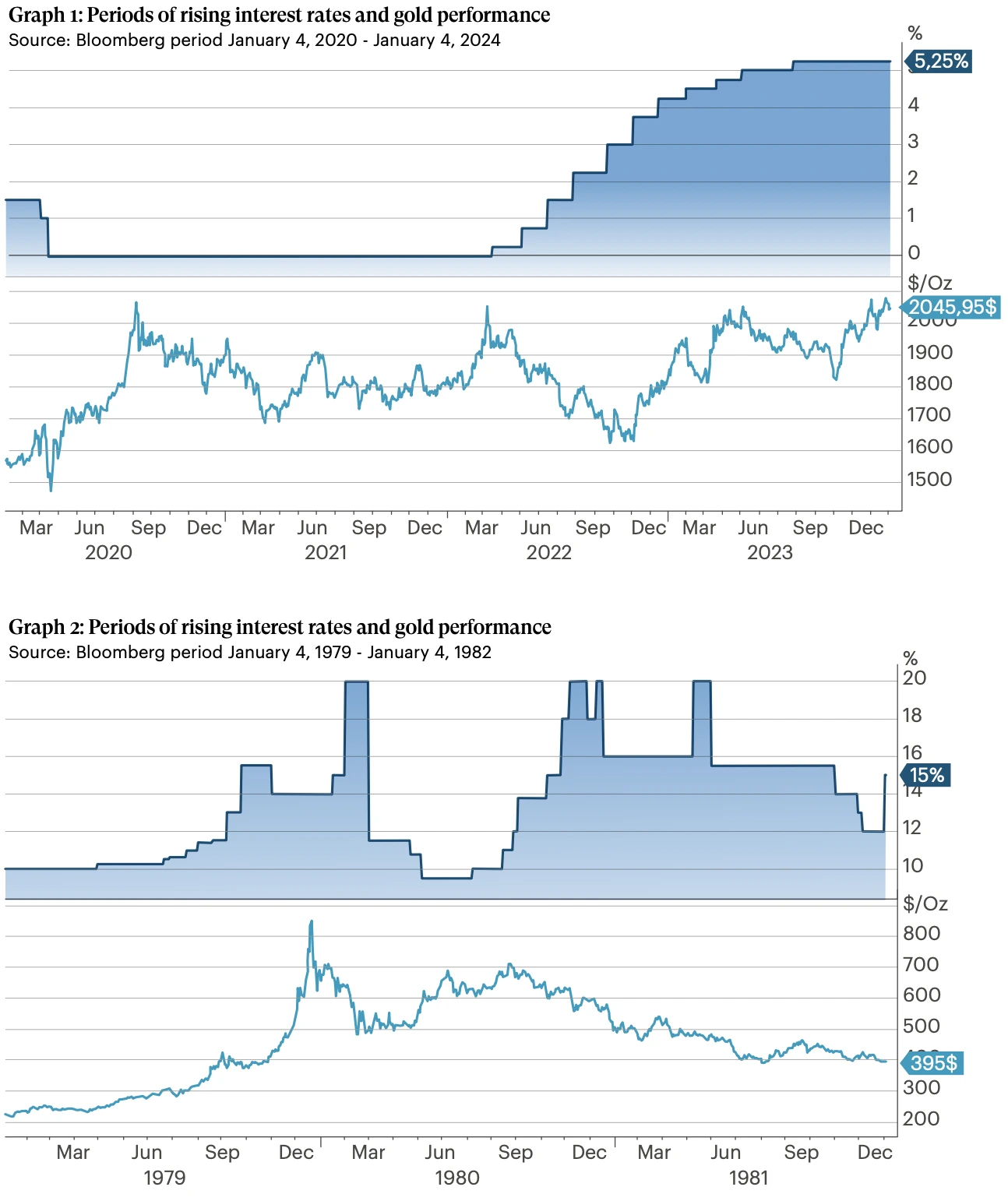

As this article is a follow-up on what has been written in previous editions of “Le Point”, we simply focus on the current situation. On one hand, one may have logically expected that gold would rise given the vast amount of geopolitical tensions in the world. On the other hand, when interest rates rose significantly, this should have had a negative impact on gold.

Last year when FED funds rate went up, gold’s performance was interesting as it was close to long-term average equity return. Also, given the elevated geopolitical tensions, we would have expected gold to rise more.

Obviously, there’s no one single reason that could explain precious metals prices behavior, it’s a range of reasons. As we said earlier, gold does not produce anything hence it isn’t seen as something that contributes to general economic growth. In addition, the relative size of the market is rather small which also drives away certain types of investors. Among other reasons that hold gold prices down, there’s is the so called “new gold”. These digital assets such as Bitcoin are attracting investors. In addition, we can mention the legacy aspect of gold, as being a store of value over time. This last feature, is also a certain type of an indicator, meaning that if the price of gold goes one or the other direction, there will be operators to interpret this as a specific signal.

The precious metal allocation is also suggested by some investors as a diversifier and some started creating exposure in their portfolio. Overall, however, we can observe that the general sentiment which is reflected in the commodity markets, suggest that there’s some stabilization in prices.

What could be the takeaways?

On one hand, the specific case of gold today does not seem obvious in the investment universe today. More investors focus on new types of securi- ties, which have some of the features of gold. In addition, yields becoming more attractive both in bonds and equities, relinquishing the idea of investing in something like gold. This is indeed a logical approach given relative attractiveness of these assets.

On the other hand, precious metals demonstrated their use as stabilizer in a portfolio during the recent past and it usually seems to be a better moment to invest in an asset when the “crowd” isn’t paying attention to it. This being said, every asset has its pros and cons and should be considered with all the aspects.

Precious metals demonstrated their use as stabilizer in a portfolio during the recent past and it usually seems to be a better moment to invest in an asset when the “crowd” isn’t paying attention to it.