Inflation, deflation and stagflation

By Marsel Paraev, Senior Portfolio Manager

Our readers know that in our previous editions we’ve already talked about inflation and its negative effects on economic agents and the economy overall. Now that it’s accepted that inflation is real and it is here, I would like to discuss all the concepts related to the general level of prices in the economy: inflation, deflation and stagflation. In order to be perhaps, more relevant, we will try to see how our discussion can be useful in the light of an investment portfolio with embedded measures to alleviate the risks involved.

As a reminder let’s start with their definitions and for simplicity sake, I will use the same online source, Investopedia, to define each of them:

- Inflation is a rise in prices, which can be translated as the decline of purchasing power over time

- Deflation is a general decline in prices for goods and services, typically associated with a contraction in the supply of money and credit in the economy

- Stagflation is an economic cycle characterized by slow growth and a high unemployment rate accompanied by inflation

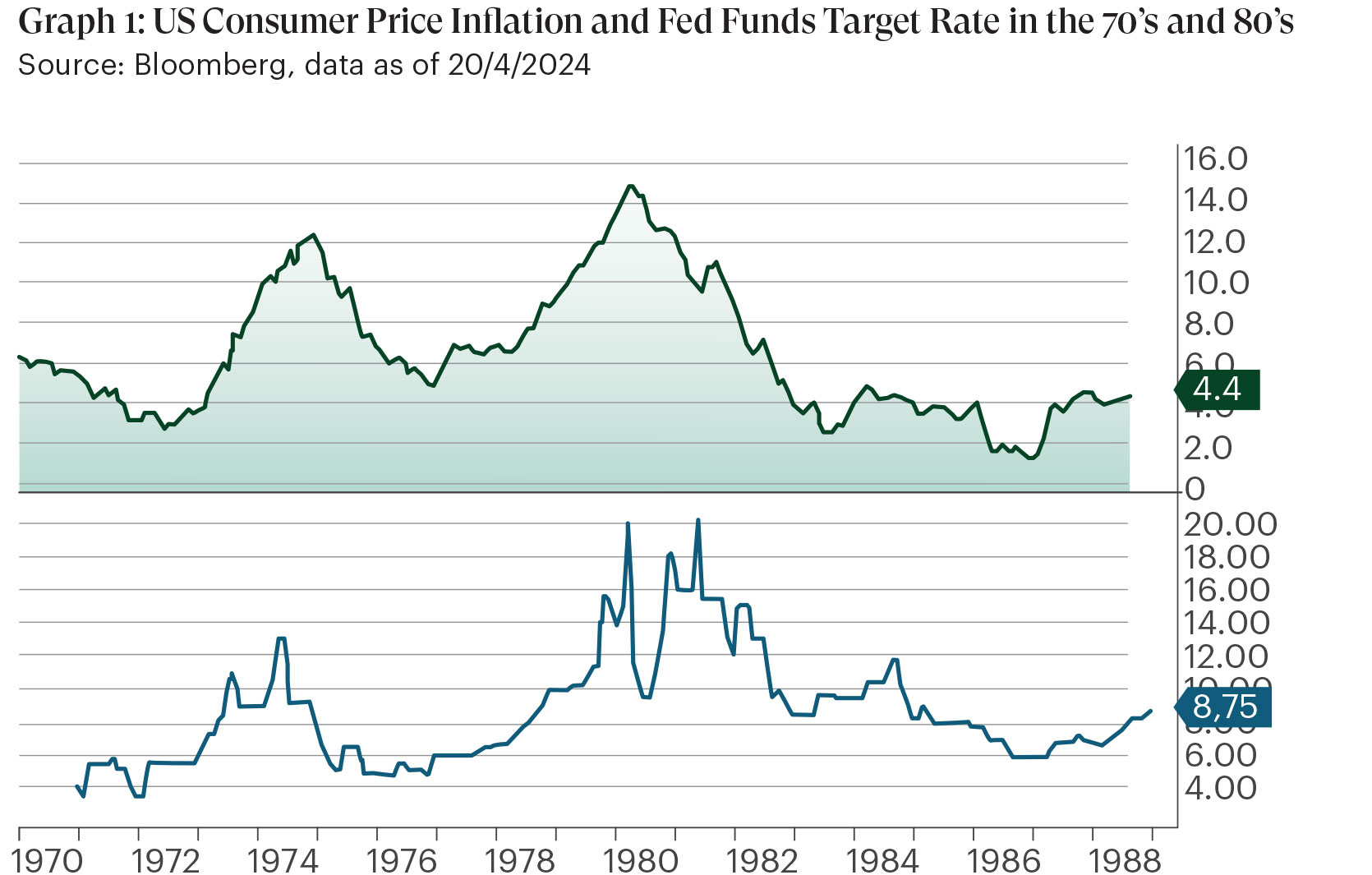

Let us start with the effects of inflation. It is widely accepted that high inflation is bad because it eats purchasing power hence it alters the standard of living of a given region or economy. Now that it is back, after a prolonged period of absence which was enabled by several factors such as globalization, innovation and productivity increase, we see that Central Banks have the tools and knowledge on how to fight inflation.

However, what about the other 2 possible economic conditions? Deflation and stagflation, are perhaps even worse than inflation. Using the definition, we can quickly see what can be a considerable problem in the case of deflation. In the second half of the last century, there were many innovations such as credit cards which have contributed to the development of the credit industry overall. This in turn, helped create a consumer-based economy which is a significant part of the US GDP contribution today. The principle is fairly simple, the ample availability of credit gave the possibility to every consumer to spend more than earn. Hence, increasing demand which helped to fine tune the level of inflation through credit expansion or contraction. So, if deflation comes back, it implies a postponement of consumption which usually has an impact on credit and the result is a shrinking economic activity with heavy consequences. In the same time, most of the budgets, if not all, are built on the assumption that there will be growth. If there is no growth, then budgets are not balanced, because there are less revenues and less taxes which creates complicated situations for many economic participants.

In their paper, Ben Bernanke and Harold James (1990), study the concept of deflation in length, but for the sake of this article, I will put forward only a few excerpts:

- “Our focus, however, is on a channel of transmission that has been largely ignored by the recent gold standard literature; namely, the disruptive effect of deflation on the financial system”

- “However, we do not want to lose sight of a second potential effect of falling prices on the financial sector, which is “debt deflation” (Fisher 1933; Bernanke 1983; Bernanke and Gertler 1990). By increasing the real value of nominal debts and promoting insolvency of borrowers, deflation creates an environment of financial distress in which the incentives of borrowers are distorted and in which it is difficult to extend new credit. Again, this provides a means by which falling prices can have real effects.”

In the above extracts from the paper, we see a few interesting points particularly relevant for our current environment.

In the US, the government debt is above 120% of GDP, the overall liabilities are estimated to be even bigger and the deficit published in March 2024 is -6.44%. You probably read about this in the media, but all of this is happening while there is strong employment, economic growth and the US is not a direct party to an important geopolitical conflict. These conditions are not sustainable according to history and in my view deserve closer attention. So, what are the possibilities that an investor may be contemplating?

Interested in the full article? Download the article below.